Due to the fact that insurance firms use different factors to price rates, the most inexpensive insurance provider before an offense probably won't be the cheapest after - division of motor vehicles. As a matter of fact, our evaluation found that while Geico had the most inexpensive average yearly rate for a great motorist with minimal coverage, after a drunk driving the rate boosted by greater than 150%, pushing the business out of the top five most inexpensive companies for an SR-22 in The golden state.

How Lengthy Does SR-22 Last? Just how long do you have to have an SR-22?

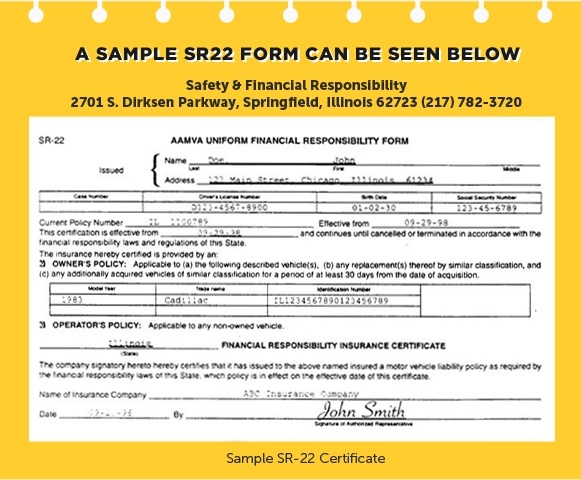

An SR-22 is a certification of economic obligation required for some motorists by their state or court order. An SR-22 is not an actual "kind" of insurance coverage, yet a kind submitted with your state - insurance companies.

Not everyone requires an SR-22/ FR-44.: DUI sentences Careless driving Accidents created by without insurance drivers If you require an SR-22/ FR-44, the courts or your state Electric motor Automobile Division will certainly inform you.

Is there a cost connected with an SR-22/ FR-44? This is a single cost you should pay when we file the SR-22/ FR-44.

Sr22 Car Insurance Sc: Everything You Need To Know Things To Know Before You Get This

A filing charge is charged for every individual SR-22/ FR-44 we submit. If your spouse is on your plan and also both of you need an SR-22/ FR-44, after that the declaring cost will certainly be charged twice. Please note: The cost is not consisted of in the rate quote since the declaring fee can vary.

For how long is the SR-22/ FR-44 legitimate? Your SR-22/ FR-44 ought to be legitimate as long as your insurance coverage is energetic. ignition interlock. If your insurance plan is terminated while you're still called for to carry an SR-22/ FR-44, we are needed to alert the appropriate state authorities. If you do not keep continual coverage you might lose your driving benefits - no-fault insurance.

Say hi to Jerry, your brand-new insurance policy agent. We'll call your insurance provider, assess your current strategy, after that locate the insurance coverage that fits your demands and also saves you money (coverage).

division of motor vehicles dui no-fault insurance underinsured coverage

division of motor vehicles dui no-fault insurance underinsured coverage

ignition interlock sr-22 auto insurance coverage department of motor vehicles

The price of SR-22 insurance policy is often significantly more than the cost of conventional car insurance policies, as insurance policy holders with previous driving violations are considered high-risk to guarantee. Exactly how do I obtain SR-22 insurance coverage in Wisconsin? To get SR-22 insurance policy protection in Wisconsin, you will certainly require to collaborate with a cars and truck insurance provider accredited to do business in the state.

If you're submitting an SR-22 form as an under-18 driver, let the insurance provider recognize the filing is in lieu of sponsorship, indicating that you're requesting protection to drive under the age of 18 without a parent or View website guardian as an enroller. When your insurance provider submits the SR-22 type on your part, it will usually bill a flat charge in between $15 and also $50.

The smart Trick of For How Long Do You Need Sr22 Insurance In Ohio? That Nobody is Talking About

underinsured underinsured insurance companies insurance companies sr22 insurance

underinsured underinsured insurance companies insurance companies sr22 insurance

Electronically submitted SR-22 certificates ought to be reviewed your driving record within a couple of company days. Upon refining the SR-22 type, the DMV must send you a letter confirming proof of insurance policy protection which you are lawfully eligible to drive again - insurance. For how long is SR-22 insurance policy coverage needed in Wisconsin? In Wisconsin, vehicle drivers are called for to hold SR-22 insurance filings for 3 years from the date their licenses are eligible to be reinstated (sr-22 insurance).

To find the least expensive price for SR-22 insurance in Wisconsin, we advise for SR-22 quotes from several insurance providers (liability insurance). Insurance provider analyze danger in different ways and charge different costs accordingly, so browsing for several quotes is typically the best approach to locate inexpensive SR-22 insurance policy. insurance. We additionally advise making inquiries concerning prospective discount rates, as motorists are usually eligible for price decreases based upon their automobile type, driving record, engagement in a defensive driving course, being a good pupil as well as much a lot more.

In Wisconsin, all drivers under age 18 are required to have an enroller to acquire a vehicle driver's license or trainer's license. Severe driving violations such as Drunk drivings or Duis (driving while intoxicated or damaged), hit-and-runs or careless driving can lead to retraction or suspension of a driver's certificate, along with the requirement for a work certificate.